Abstract

Cryptocurrency is one of the fastest-growing asset classes, growing by over 130% CAGR in the past 8 years. Nevertheless, investing in cryptocurrencies can be challenging given that it is not easy to understand, thus making it difficult for investors to choose which cryptocurrency to invest in from over 4000 options.

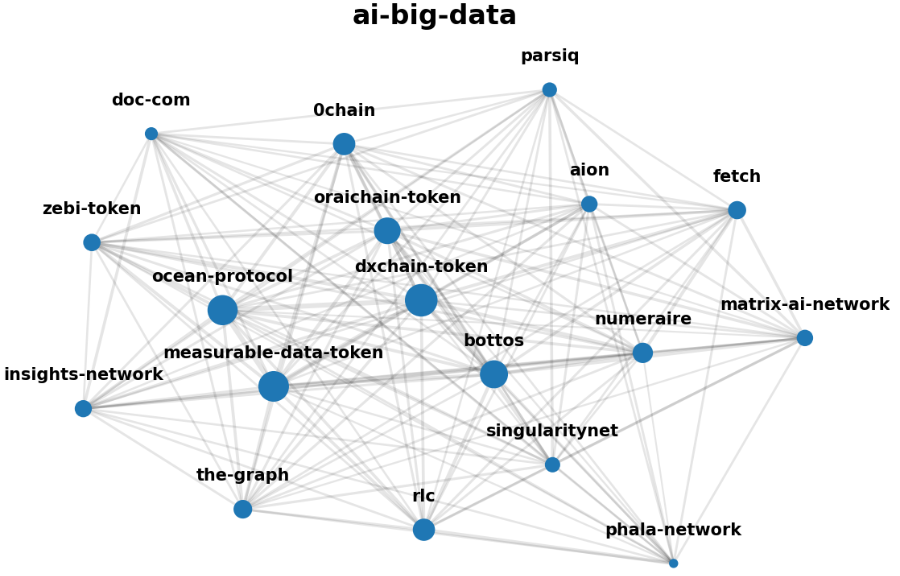

This study aims to address this by finding a way to systematically identify key cryptocurrencies using network science, by using cryptocurrencies as the nodes and using the similarity between use-case descriptions as the edges. From this large network, we present how we can create sub-graphs using keyword tags from CoinMarketCap and identify central nodes in these sub-graphs to arrive at a shortlist of cryptocurrencies. These shortlisted cryptocurrencies can then be prioritized by ranking them based on their normalized degree centrality.

Finally, we demonstrate how cryptocurrencies identified based on this methodology delivered 73% to 446% return in the past 30 to 90 days, which outperforms investing in cryptocurrencies with the highest market capitalization by 53% to321% over the same period.