Abstract

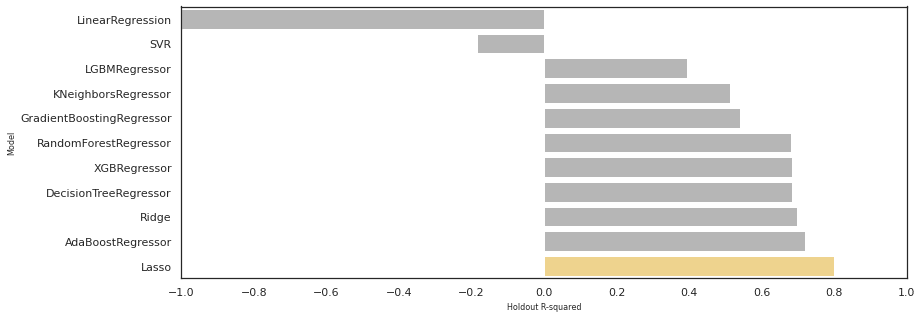

The practice of valuation is integral in business. Some selected applications include buying and selling startups for entrepreneurs and companies, raising capital for business owners, and assessing the fair value of stocks for individual portfolios. However, the current methodologies in valuations take time and are exposed to human biases. Hence the problem statement of this study is “How can we estimate the value of a business more efficiently and objectively?”. The data used in this study was extracted from the S&P Global Market Intelligence web-based application containing all financial metrics from all 247 companies belonging to 10 sectors. The researchers applied various supervised machine learning techniques such as regression-based methods, support vector techniques, decision trees, and ensemble methods. The best model is Lasso with 82.7% average accuracy. The model provides an efficient and objective way of producing a baseline valuation to supplement existing methodologies, especially discounted cash flow or the “DCF” method. Interpretation of the model revealed that business valuation can be significantly explained by (1) operational efficiency, (2) total debt & equity, and (3) previous year’s margins. In conclusion, this study provided a method to provide a baseline value for privately held companies in an automated manner. It could also give an indication of whether companies are undervalued or overvalued as of a specific date with respect to the market. Finally, it can serve to supplement existing methodologies to alleviate the subjectivity in the valuation practice.